How to Calculate Payroll: A Complete Step-by-Step Guide

In the world of business, one of the most crucial administrative tasks is the accurate calculation of payroll. Whether you’re a small business owner or a human resources professional, understanding the intricacies of payroll calculation is essential for the smooth operation of any organization.

This comprehensive guide will walk you through the fundamental steps of calculating payroll, the different methods available, legal requirements that must be adhered to, and common pitfalls to avoid.

By the end of this article, you will have a clear understanding of what payroll entails and the best practices for ensuring accuracy and compliance. So, let’s delve into the intricate world of payroll calculation and equip ourselves with the knowledge to navigate this essential business function.

What Is Payroll?

Payroll is a crucial aspect of a business’s operations, involving the process of calculating and distributing employee compensation, as well as withholding and paying taxes to the appropriate government entities.

Efficient payroll management ensures that employees are compensated accurately and on time, playing a vital role in maintaining their satisfaction and motivation. It involves adhering to tax obligations by accurately withholding and remitting employee taxes, employer taxes, and other mandatory deductions.

To streamline these processes, many businesses implement payroll software to automate payroll calculations, generate payslips, and track tax liabilities, which significantly reduces the potential for errors and ensures compliance with tax laws and regulations.

Why Is It Important to Calculate Payroll Correctly?

Calculating payroll correctly is essential to ensure accurate compensation for employees, compliance with tax regulations, and the proper management of benefits and deductions within the business.

Accurate payroll calculations play a pivotal role in fostering trust and satisfaction among employees. When employees receive their wages promptly, accurately, and transparently, it enhances their morale and loyalty to the company. Precise payroll processing also ensures compliance with tax laws and regulations, avoiding potential penalties and legal issues.

It contributes to the efficient administration of employee benefits, including health insurance, retirement plans, and other perks, which are integral in attracting and retaining top talent.

What Are the Steps to Calculate Payroll?

Calculating payroll involves several key steps, from determining the pay period to processing employee payments and maintaining accurate documentation of the payroll operations.

The first step in payroll calculation begins with tracking employees’ time worked, ensuring that hours are accurately recorded and managed. Once the time tracking is completed, it is essential to utilize payroll software that can streamline and automate the process, making it easier to calculate wages, deductions, and bonuses.

The next crucial aspect is tax withholding, where employee taxes are deducted as per the tax laws. After all necessary deductions are made, the payroll team processes the payments, ensuring that each employee receives their wages accurately and on time.

Maintaining detailed documentation of payroll operations is necessary for compliance and record-keeping purposes.

Step 1: Determine the Pay Period

The first step in payroll calculation is to establish the pay period, which can vary based on the payment frequency and employee classifications, such as hourly workers or salaried employees.

Determining the pay period involves careful consideration of various factors, including overtime regulations, state laws, and the specific terms of employment contracts.

For hourly workers, the pay period may align with the frequency of their work hours.

Conversely, salaried employees often have a consistent pay schedule, perhaps on a monthly or bi-monthly basis.

It is essential to adhere to the regulations related to payroll tax withholding and reporting, ensuring compliance with federal and state requirements.

Step 2: Gather Necessary Information

The next step involves gathering essential information for payroll processing, including employee details, benefits, and any voluntary deductions, ensuring compliance with payroll regulations and leveraging efficient payroll software solutions.

To establish a smooth payroll operation, employee information acts as a cornerstone. The accurate records of their personal and financial data facilitate precise salary calculations and tax withholdings. In addition, keeping track of benefits such as health insurance, retirement plans, and paid time off ensures that employees receive the entitled perks.

Accounting for voluntary deductions like charitable contributions and retirement savings plans enables employees to optimize their financial planning.

Bolstering this process with state-of-the-art payroll software solutions not only streamlines the process but also aids in ensuring compliance with intricate payroll regulations.

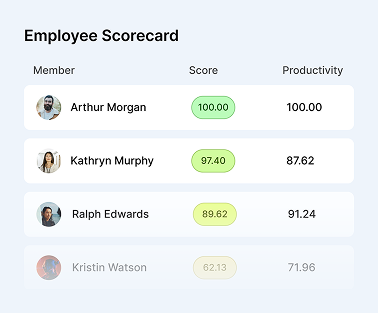

Maximize productivity of your business

Track employee productivity and simplify work with them

Step 3: Calculate Employee Hours

Once the necessary data is collected, the calculation of employee hours based on their work schedule and compensation structure is a critical aspect of the payroll operation, contributing to accurate net pay and payroll tax returns.

Employers typically use time tracking systems or software to record employees’ hours worked, including any overtime or break periods, directly translating into accurate calculations of their total hours. This data is crucial for determining the net pay of employees, as it directly impacts the amount they receive in their paycheck.

By applying the appropriate tax rates to the total hours worked, employers can accurately withhold taxes and report the payroll taxes owed to the relevant authorities.

The accurate calculation of employee hours also plays a vital role in ensuring compliance with labor laws and regulations, thereby minimizing the risk of potential penalties or legal issues for the employer.

Step 4: Calculate Gross Pay

The calculation of gross pay involves determining the total earnings of employees before tax deductions, considering both salary and hourly basis, leading to accurate payroll payments and tax calculations.

To calculate gross pay for salaried employees, one must multiply the employee’s total yearly salary by the number of pay periods in a year.

On the other hand, for hourly employees, the gross pay is calculated by multiplying the number of hours worked by the hourly wage.

Once the gross pay is determined, it becomes the basis for various tax deductions, such as federal and state income tax, Social Security, and Medicare. These deductions play a crucial role in determining the employee’s net pay and also influence overall payroll calculations.

Step 5: Calculate Taxes and Deductions

The next step involves the intricate process of calculating and withholding federal and state taxes, including income tax and FICA tax, along with other deductions, as a crucial part of accurate payroll tax calculations.

These tax calculations are essential for ensuring compliance with numerous regulations and tax obligations, and precision and attention to detail are paramount when navigating through the complexities of tax laws.

The calculations are not limited to just the employee’s portion; the employer must also accurately compute and deposit their share of FICA and FUTA taxes, adhering to the specific filing schedules set by the respective tax authorities.

Along with federal and state taxes, accounting for local taxes may be necessary, depending on the region in which the business operates, further adding to the intricacies of the overall tax calculation process.

Step 6: Calculate Net Pay

The final step in the payroll calculation process is arriving at the net pay for employees, requiring accurate documentation, record-keeping, and the generation of comprehensive payroll reports for transparency and compliance.

Calculating net pay accurately is crucial for ensuring that employees receive their rightful earnings. It involves considering various factors such as hours worked, overtime, bonuses, deductions, and any other adjustments. Documenting these details meticulously is essential to maintain a clear and transparent record of payments made.

Record-keeping plays a pivotal role in demonstrating compliance with labor laws and regulations, ensuring that the payroll process aligns with legal requirements. By maintaining thorough records, employers can provide evidence of their adherence to industry standards and statutory obligations.

The generation of comprehensive payroll reports not only enhances transparency but also facilitates decision-making and auditing processes. These reports offer insights into the financial aspects of an organization, serving as valuable tools for management and financial analysis.

What Are the Different Methods for Calculating Payroll?

Businesses employ various methods for calculating payroll, including manual computation, the utilization of advanced payroll software solutions, and the outsourcing of payroll processing to dedicated service providers.

Manual computation, although traditional, can be time-consuming and prone to errors. In contrast, advanced payroll software solutions offer automation, accuracy, and efficient record-keeping, making them popular among medium to large enterprises.

Outsourcing payroll to dedicated service providers provides businesses with the opportunity to streamline their operations and focus on core activities, while ensuring compliance with complex tax regulations and labor laws.

Manual Calculation

Manual payroll calculation involves the detailed computation of employee compensation and tax deductions without the reliance on automated systems, necessitating meticulous processing for accurate payroll payments.

Ensuring precise manual compensation calculations may involve factoring in various elements such as base salary, overtime, bonuses, and deductions for benefits. Tax deductions, including federal and state taxes, social security,

Medicare, and other withholdings, add another layer of complexity to the manual payroll process. Staying abreast of constantly changing tax laws and regulations further compounds the challenge of handling manual compensation and deductions.

This necessitates thorough understanding, attention to detail, and adherence to compliance standards to avoid errors and ensure timely and accurate payments to employees.

Using a Payroll Software

Employing dedicated payroll software provides businesses with streamlined processes for employee payments, payroll management, compliance, and comprehensive documentation, enhancing operational efficiency and accuracy.

With specialized payroll software, organizations can automate the calculation and processing of wages, taxes, and benefits, saving considerable time and effort. This leads to fewer errors and ensures timely and accurate disbursement of funds to employees.

Payroll software facilitates the seamless management of employee data, including leave, attendance, and tax information, fostering better workplace compliance and adherence to regulations.

The comprehensive documentation features of payroll software simplify record-keeping and auditing, contributing to enhanced transparency and accountability within the organization.

Outsourcing to a Payroll Service Provider

Outsourcing payroll processing to specialized service providers relieves businesses of the intricate payroll operations, ensuring compliance with tax regulations and the timely execution of payroll tax obligations.

Employing an outsourced payroll service not only streamlines the complex payroll procedures but also brings about significant benefits in terms of time and resource-saving. By leveraging the expertise of professionals in the field, businesses can ensure accuracy in payroll calculations, deductions, and paychecks issuance, thus reducing the chances of errors and inconsistencies.

Outsourcing payroll services allows companies to stay updated with the ever-changing tax laws and regulations, mitigating any risks of non-compliance. With the burden of payroll management lifted, business owners and HR personnel can redirect their focus to core operational activities, fostering business growth and productivity.

What Are the Legal Requirements for Payroll Calculation?

Legal regulations governing payroll calculation encompass crucial aspects such as minimum wage laws, overtime pay requirements, and tax laws, including federal and state income tax obligations and accurate payroll tax returns.

Employers must uphold the minimum wage laws which establish the lowest permissible hourly rate that employers can pay their employees. It is crucial to adhere to both federal and state minimum wage regulations, ensuring that employees are receiving fair compensation for their work.

Overtime pay requirements necessitate that eligible employees receive compensation at a rate of one and a half times their regular pay for hours worked over 40 in a workweek. Complying with these provisions is essential to avoid legal repercussions.

Tax laws play a significant role in payroll calculation. Employers must withhold federal and state income taxes from employees’ paychecks, ensuring accurate deductions based on the respective tax brackets and allowances. It is vital to administer these withholdings correctly to fulfill the tax obligations and prevent penalties.

Accurate payroll tax returns are crucial to fulfill the federal and state tax requirements. Employers must file these returns regularly, reporting the wages paid and the corresponding taxes withheld. Failing to meet these obligations can lead to severe consequences.”

Minimum Wage Laws

Minimum wage laws establish the baseline compensation that employers must adhere to, ensuring fair remuneration for employees and compliance with payroll responsibilities and related tax obligations.

These laws play a crucial role in ensuring that employees receive a just wage for their work, reflecting the cost of living and economic conditions. They uphold state tax compliance by setting a standard for income reporting and withholding requirements based on the prescribed wage rates.

Employers are tasked with the responsibility of accurately calculating and disbursing wages in accordance with these laws, further emphasizing the importance of compliance and transparency in payroll management.

Overtime Pay Laws

Overtime pay laws dictate the additional compensation employees receive for working beyond standard hours, requiring meticulous adherence to FICA tax regulations and comprehensive payroll tax compliance.

Employers must ensure that their payroll systems are equipped to calculate overtime pay accurately and reflect the additional compensation in employees’ paychecks. It’s crucial to stay updated with any changes in employment laws to avoid potential penalties and legal consequences.

Apart from the financial implications, effective management of overtime pay is essential for maintaining employee satisfaction and retention. Failing to comply with overtime pay laws can lead to decreased morale and productivity, which can hinder a company’s overall performance.

Tax Laws

Tax laws encompass federal and state tax regulations, withholding requirements, and comprehensive payroll tax obligations, necessitating strict adherence to legal frameworks and meticulous payroll regulations.

The ever-evolving nature of tax laws poses a significant challenge for businesses and individuals alike, requiring them to remain abreast of the latest updates to ensure compliance. Federal tax regulations, including provisions for income taxes, capital gains taxes, and estate taxes, form a complex web of obligations that necessitate careful navigation.

Similarly, state tax regulations, such as sales tax, property tax, and corporate income tax, add another layer of intricacy, often varying widely across different regions.

What Are the Common Mistakes to Avoid When Calculating Payroll?

Avoiding common mistakes in payroll calculation is imperative, encompassing errors in the payroll process, miscalculations, compliance pitfalls, and inaccuracies in handling payroll taxes and related calculations.

These errors can lead to significant financial repercussions for businesses, as well as potential legal and regulatory implications. One of the prevalent mistakes is the misclassification of employees, which can result in non-compliance with labor laws and overtime regulations.

Overlooking the intricacies of benefits withholding and reporting can lead to IRS scrutiny and penalties.

– The Monitask Team

Frequently Asked Questions

What is included in payroll calculations?

Payroll calculations include the employee’s wages, benefits, and taxes. Wages can include hourly or salaried pay, bonuses, commissions, and overtime. Benefits may include health insurance, retirement contributions, and other pre-tax deductions. Taxes typically include federal, state, and local income taxes as well as Social Security and Medicare taxes.

How can I ensure accurate payroll calculations?

To ensure accurate payroll calculations, it is important to have all necessary information and documentation from employees and stay updated on any changes to tax laws or regulations. It is also helpful to use a reliable payroll software or consult with a professional accountant to double-check calculations.

Can I calculate payroll manually?

Yes, payroll can be calculated manually, but it is not recommended for larger companies with multiple employees. Manual calculations can be time-consuming and prone to human error. It is best to use payroll software or seek professional help to ensure accuracy and save time.

What are some common mistakes to avoid when calculating payroll?

Some common mistakes to avoid when calculating payroll include failing to account for all necessary deductions, using incorrect tax rates, and not keeping accurate records. It is also important to double-check calculations and stay updated on any changes to tax laws or regulations.

How often should payroll be calculated?

The frequency of payroll calculations depends on your company’s pay schedule, which can be weekly, bi-weekly, semi-monthly, or monthly. It is important to establish a consistent pay schedule and communicate it clearly to employees. It is also important to ensure that payroll is calculated and distributed on time to avoid any potential issues or discrepancies.