The Ultimate Independent Contractor vs Employee Checklist: How to Determine the Difference

As the gig economy continues to grow, the distinction between independent contractors and employees becomes more important for both businesses and workers.

Understanding this difference can affect tax obligations, benefits eligibility, and legal responsibilities.

In this guide, we’ll break down everything you need to know to determine whether you’re an independent contractor or an employee, and why it matters.

Employee vs. Independent Contractor: Key Differences

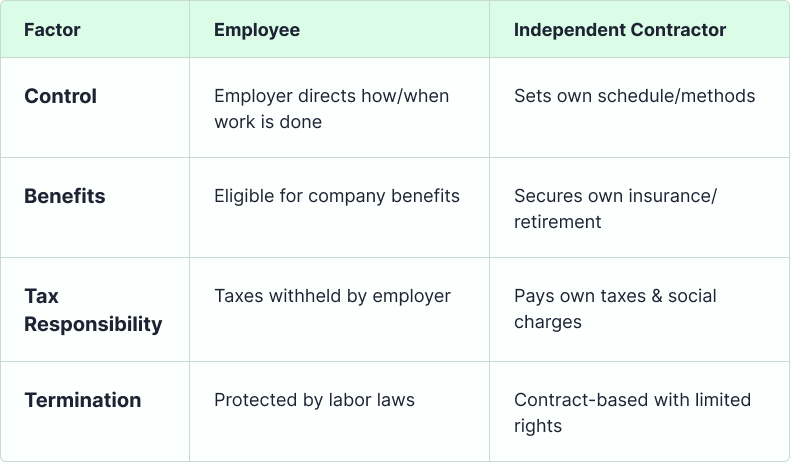

The distinction between employees and independent contractors hinges on four main factors: control, benefits, and tax responsibilities and termination.

Understanding these key differences isn’t just about labels—it shapes the entire working relationship.

While employees trade autonomy for stability and benefits, independent contractors accept greater responsibility in exchange for flexibility and control.

Getting this classification right from the start protects both parties and sets clear expectations for the engagement.

How to Determine If You Are an Independent Contractor?

The distinction between an independent contractor and an employee hinges on the degree of control and integration in the work relationship. If your employer provides detailed instructions on how to complete tasks, supervises your methods, or requires adherence to specific processes, this suggests an employee relationship. Independent contractors, by contrast, retain autonomy over how they execute their work, deciding their own processes and schedules without direct oversight.

Another key factor is training. Employees often receive job-specific training from their employer, indicating that the company directs how the work should be performed. Independent contractors, however, are typically hired for their existing expertise and are expected to work independently without company-led training.

Integration into the business also plays a role. Employees usually perform work that is central to the company’s operations, functioning as part of the core workforce. Independent contractors, on the other hand, tend to work on specialized or temporary projects that are separate from the business’s day-to-day functions.

Additionally, the ability to delegate work differs between the two classifications. Employees are generally expected to perform their duties personally, while independent contractors can hire and pay their own assistants or subcontractors to help complete the job. This distinction highlights the contractor’s role as an independent business entity rather than an integrated employee.

By evaluating these factors—control over work, training, business integration, and delegation—you can better assess whether you qualify as an independent contractor or an employee.

Pros and Cons of Being an Independent Contractor

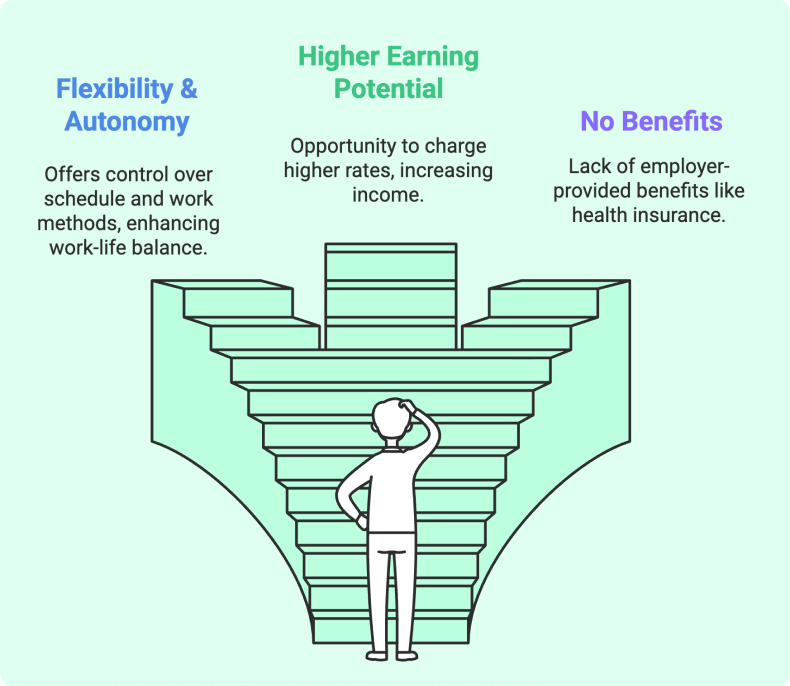

Key Advantages

- Flexibility: Independent contractors have control over their schedule and workload.

- Autonomy: They can choose their clients, projects, and work methods.

- Higher Earning Potential: Contractors often have the opportunity to charge higher rates than employees.

Key Disadvantages

- No Benefits: Independent contractors do not receive health insurance or retirement contributions from employers.

- Tax Burden: Contractors must pay both the employer and employee portions of Social Security and Medicare taxes.

- Inconsistent Income: Workload and income can fluctuate from month to month.

Common Examples of an Independent Contractor

Best Practices For Working With An Independent Contractor

Successful collaborations with independent contractors hinge on clarity, communication, and alignment from day one. Start by drafting a detailed contract that explicitly outlines the scope of work, deliverables, deadlines, and payment terms—this document serves as both a roadmap and a safeguard for both parties.

Regular communication is equally critical. Schedule check-ins to address questions, provide feedback, and adjust priorities as needed, ensuring the project stays on track without micromanaging the contractor’s process.

Finally, invest time upfront to define expectations. Discuss not only the “what” (e.g., final deliverables) but also the “how” (e.g., preferred tools, reporting frequency). This mutual understanding minimizes conflicts and fosters a productive, professional relationship.

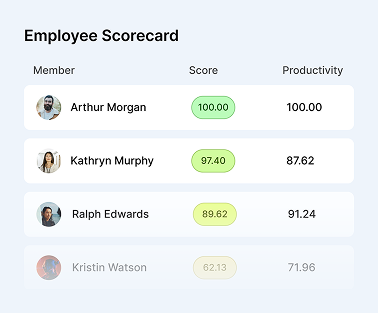

Maximize productivity of your business

Track employee productivity and simplify work with them

Checklist For Determining Whether You Are an Independent Contractor Or An Employee:

If you’re unsure about your classification, refer to this checklist:

If you answered “yes” to these questions, you’re likely an independent contractor. If not, you’re probably an employee. Clarifying this distinction can help you avoid costly mistakes and ensure proper tax filing.

This checklist and guide should give you the tools to determine whether you’re working as an independent contractor or as an employee. If you’re still uncertain, it’s a good idea to consult with a legal or tax professional for more guidance.

Conclusion: Proper Worker Classification

Proper worker classification isn’t just about labels—it shapes your financial obligations, legal protections, and professional autonomy. Employees gain stability through benefits and employer tax withholdings, while contractors trade security for flexibility and higher earning potential.

Misclassification risks penalties for businesses and lost protections for workers. When in doubt, consult an employment or tax specialist—a small investment now prevents costly legal or financial consequences later.

Your work arrangement should reflect your actual relationship with the hiring entity, not just what’s written in a contract. Stay informed, stay compliant, and structure engagements to match your professional goals!

– The Monitask Team

FAQ: Contractor vs. Employee

How do I know if I'm being misclassified as an independent contractor?

If you’re working for a company but don’t have the flexibility or autonomy typically given to independent contractors, you may be misclassified. For instance, if your employer controls your schedule, provides extensive training, or supervises your daily tasks, these are signs you might actually be an employee. If you’re unsure, you can file a form SS-8 with the IRS to have your status reviewed.

Can I work as both an independent contractor and an employee at the same time?

Yes, you can work both as an employee and as an independent contractor. Many people work part-time jobs as employees while also offering freelance services or consulting as independent contractors. However, the tax obligations for each classification will differ, and it’s essential to keep your income sources separate and properly report them.