How to Survive Inflation: Boost Your Salary and Protect Your Money

Inflation is a scary word for many people. It can mean the difference between having a comfortable life and struggling to make ends meet. For people who are already struggling, inflation can be disastrous.

Luckily, there are things you can do to protect yourself from inflation and boost your salary during these unstable times. In this blog post, we will discuss some of the best ways to survive inflation and keep your money safe!

We know it can be confusing to understand why you have been working 40 hours per week to get your money, only for it to go “puff” in a matter of minutes while doing your shopping sprees. Where did your money go?

Inflation could be to blame!

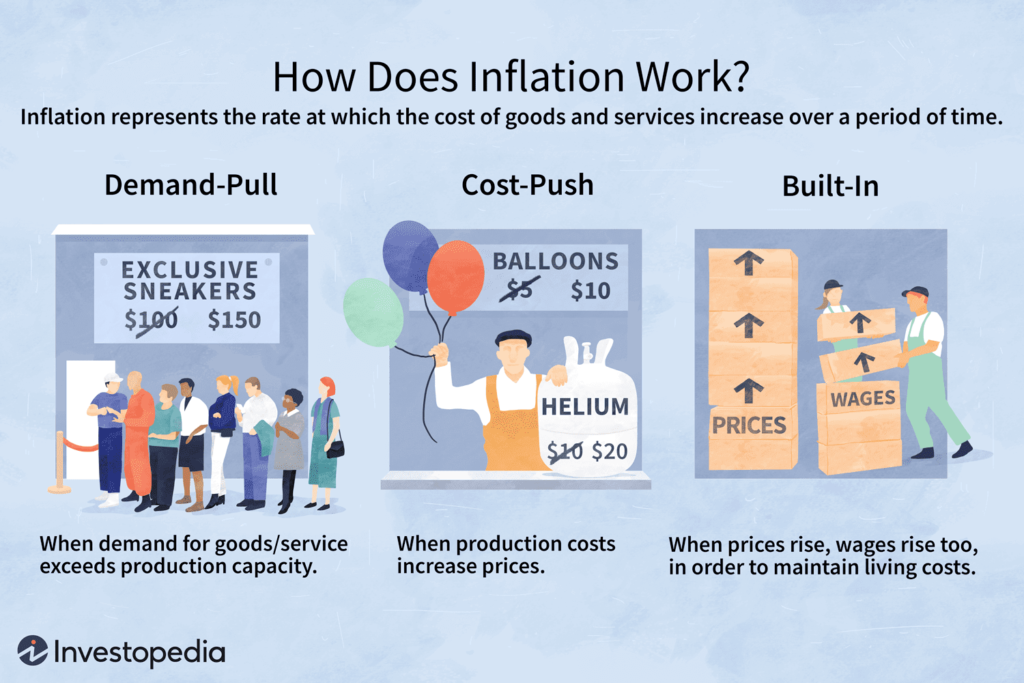

According to the International Monetary Fund, inflation “is the rate of increase in prices over a given period of time. Inflation is typically a broad measure, such as the overall increase in prices or the increase in the cost of living in a country. But it can also be more narrowly calculated—for certain goods, such as food, or for services, such as a haircut, for example. Whatever the context, inflation represents how much more expensive the relevant set of goods and/or services has become over a certain period, most commonly a year.”

Sustained inflation is when the inflation rate is above 0% for a prolonged period of time. This can cause serious economic problems, as it erodes the purchasing power of people’s wages and savings.

Inflation can also harm businesses, as it increases their costs while at the same time eroding the value of their sales. Sustained inflation can be caused by a variety of factors, including:

- an increase in the money supply

- a decrease in productivity

- higher oil prices

- increased government spending

All these factors can sound very foreign to us, but what it all comes down to is that inflation affects us in our daily lives. It can be a good thing or a bad thing, depending on how well we manage it.

If inflation is high and your salary does not increase at the same rate, then your purchasing power diminishes. This means that you will not be able to buy as much with your money. In some cases, inflation can even outpace wage growth, which can lead to hardship for many families.

Everyone is aware of how COVID-19 caused economic constriction worldwide!

COVID-19 and Inflation in the US

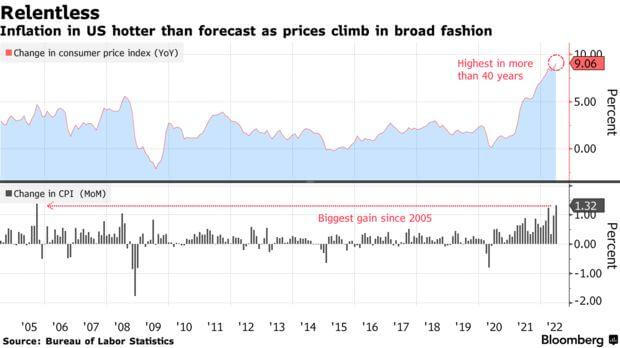

The inflation rate in the United States has been below the Federal Reserve’s target of two percent for most of the past decade. However, inflation has begun to pick up in recent months as the economy has recovered from the pandemic.

The inflation rate reached a five-year high of two point seven percent in February 2021. This was driven by rising prices for gasoline, housing, and food. In the remaining months of 2022, inflation is expected to slow down as the effects of the pandemic continue to dissipate, yet inflation is still one of the higher in the last 40-year inflation history in the US!

Consult the inflation rate forecast here.

Wage growth has also been picking up in recent months. After adjusting for inflation, average hourly earnings rose four percent in February 2021 from a year earlier. This was the biggest increase since July 2009.

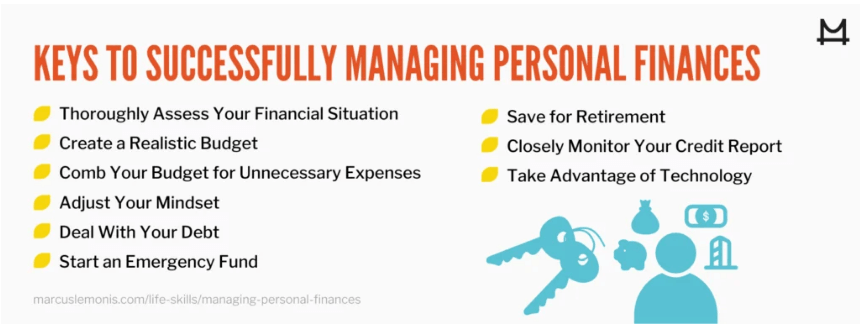

With this being said, it is more important than ever to stay on top of your finances and understand how inflation can affect you. There are ways to protect yourself from inflation and even ways to grow your salary during inflationary periods.

So how do you protect your money and purchasing power during inflation? Let’s review some strategies!

How to Boost Your Salary During Inflation

The last 2 years have been exhausting! COVID-19 lockdown really put our heads on a rollercoaster, and even after we are mostly COVID-19 free, we are still dealing with its aftermath. To keep up with inflation, it is important to be proactive about boosting your salary.

Let’s protect your purchasing power and grow your salary at the same rate (or higher) than inflation!

Re-Negotiate Your Salary

Have you ever thought about saying: “Hey, I deserve a raise!”? If you haven’t, you are in the 57,2% of people that never have tried to negotiate their salary. Why? Out of fear? Maybe. However, read this! According to Fidelity Investments, 87% of Americans who negotiated their salary actually got what, a least, some of what they asked!

The first step you can take to inflation-proof your salary is to try and negotiate a higher wage with your employer. If you have been with your company for more than a year and are performing well, then you may be due for a raise.

It never hurts to ask, and in fact, it may be just what you need to stay ahead of inflation. If you are unsure about how to approach the topic of salary negotiation with your boss, take a look at the image below for some tips:

Look for a New Job

Stating the obvious! If your attempts at re-negotiating your salary went down through the pipes, looking for a new job could be the best solution. This may seem like a daunting task, but with inflation on the rise, it is worth considering.

When looking for a new job, it is important to take inflation into account. This means considering jobs that offer higher wages or positions in industries which are growing.

The key is to research industries that are growing and look for positions that match your skillset

Many online resources can help you find a new job, such as Indeed, Glassdoor, and LinkedIn. These websites can help you research different industries and find positions that match your skill set.

Take Advantage of Employee Benefits

Employee benefits are often overlooked when it comes to inflation-proofing your salary. However, they can be a great way to offset the effects of inflation. Many companies offer benefits such as health insurance, retirement savings plans, and tuition reimbursement.

These benefits can help you save money and keep your costs down during periods of inflation

If you are not taking advantage of all the employee benefits available to you are not taking advantage of all the employee benefits available to you, now is the time to do so. These benefits can help offset the effects of inflation and keep your costs down.

Side Hustles

You’ve probably heard of the term “side hustle” before. A side hustle is a way to make extra money outside of your full-time job. There are many different ways to make money through side hustles, such as freelancing, pet sitting, or even starting your own business.

Side hustles can be a great way to inflation-proof your income. They provide you with an additional stream of income that can help offset the effects of inflation. Plus, they allow you to earn more money if you can grow your side hustle into a successful business.

Many online resources can help you find a side hustle that fits your interests and skill set. You can use sites like Upwork, Fiverr, and TaskRabbit to find side hustles that fit your professional profile. Once you find a side hustle that you are interested in pursuing, be sure to do your research and figure out how much you can realistically expect to earn.

You can also look into starting your own business as a way to boost your income during inflationary periods. These methods may not be right for everyone, but they are worth considering if you want to take control of your earnings and protect your purchasing power.

Invest in Yourself

Many people view their salary as simply a number that fluctuates based on inflation and the cost of living. However, your salary is much more than that.

Your salary is an indication of your worth to your employer

If you want to earn more money, you need to show your employer that you are worth more money. One way to do this is to invest in yourself.

By taking courses, learning new skills, and networking, you can make yourself a more valuable asset to your company. In turn, this will increase your earning potential and help you boost your salary.

3rd Parties Investment

One way to combat inflation is to invest your money. When you invest, you are putting your money into something that has the potential to grow in value.

This can help you keep up with inflation and even improve your financial situation. However, it is important to remember that investing comes with risk.

Before investing, be sure to do your research and understand the risks involved

There are many different ways to invest your money, including investing in stocks, bonds, and mutual funds. Each of these options has different risks and rewards. You should talk to a financial advisor to figure out which option is right for you.

Find the best investments in 2022 here.

Redesign Your Household Expenses

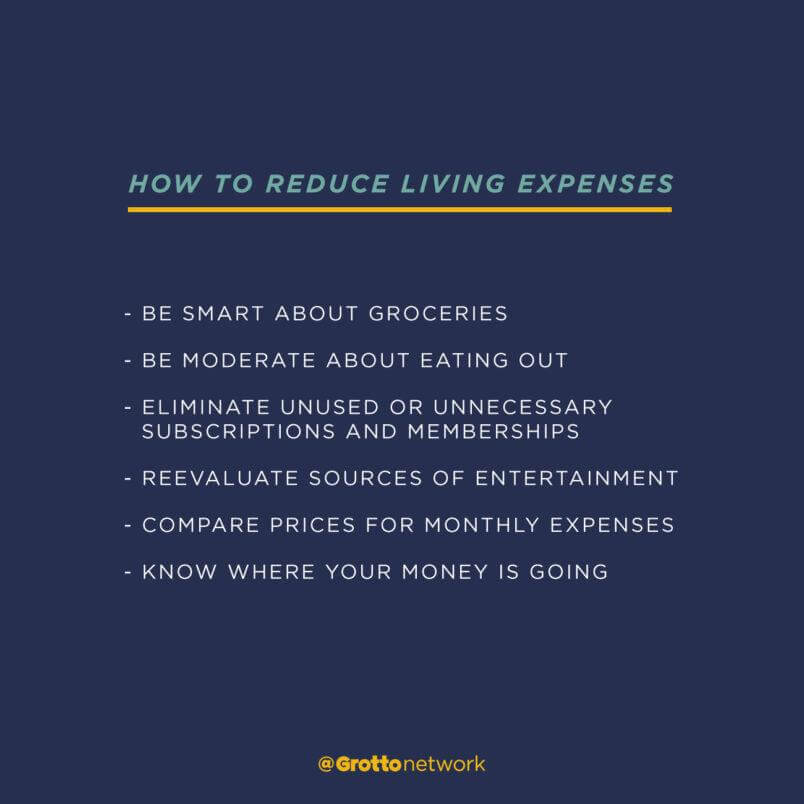

To survive inflation, you need to take a close look at your household expenses and figure out where you can cut back. This may seem like a daunting task, but it is important to remember that even small changes can make a big difference.

Many of us are spending too much money on unnecessary things like eating out, cable TV, and expensive clothes. For example, if you’re paying for cable TV, consider switching to a cheaper streaming service. You can also save money on your groceries bill by meal planning and taking advantage of sales.

By cutting back on these non-essentials, you can free up a significant amount of money each month. You can then use this extra cash to pay down debt, build up your savings, or invest in inflation-proof assets such as real estate or gold.

Track Your Finances

There are many different ways to track your finances, but one of the simplest methods is to use a budget. A budget can help you understand where your money is going and identify areas where you can cut back.

By tracking your finances closely, you can make adjustments as needed to ensure that you are always ahead of inflation

There are several different ways to track your finances, including online budgeting tools and apps, tracking your spending manually, or working with a financial advisor. Whichever method you choose, the key is to be diligent and disciplined in your approach.

Economic Resources

There are a few different economic resources that can help you keep tabs on the inflation rate. The Consumer Price Index (CPI) is one of the most widely used measures of inflation. It tracks the prices of a basket of goods and services, and it’s released monthly by the Bureau of Labor Statistics.

The CPI can be used to inflation-adjust other economic data, like wages and benefits

Another resource for tracking inflation is the Personal Consumption Expenditures (PCE) price index. This index is released quarterly by the Bureau of Economic Analysis, and it includes a wider range of items than the CPI.

Finally, the Producer Price Index (PPI) tracks inflation at the wholesale level. It’s released monthly by the Bureau of Labor Statistics. All of these inflation measures help economists identify whether prices are rising too fast or not fast enough. They also help central banks make monetary policy decisions to keep inflation in check.

These are just a few of the best economic resources for tracking inflation and keeping you updated about the economic forecast!

Take Action Now

Inflation can be a scary thing, but there are steps you can take to protect yourself. By boosting your salary, investing in yourself, and redesigning your household expenses, you can help offset the effects of inflation and improve your financial situation.

Don’t wait until inflation hits to start taking action. Take steps now to ensure that you are prepared!

While inflation is often thought of as something that happens gradually over time, inflation can also happen rapidly. This is why it is important to be prepared and have a plan in place. By following the tips above, you can help ensure that you can weather any inflationary period and come out ahead financially.

How has inflation affected your life? Have you already taken steps to protect yourself from its effects? If not, do it now!

-The Monitask Team